We need our children to be financially aware. It’s such an important life skill that will serve them well as they get their first jobs and make their way independently in the world.

There are many ways we can do this so your children will have a better understanding of the value of their money, and hopefully teach them to distinguish between wants from needs. Just to avoid them getting into debt and really struggle as they get older. It is quite easy to do if they lack financial awareness, they might make bad financial decisions and unwise investments.

Firstly, you need to start off with the basics. This means helping them recognize notes and coins in their local currency.

Becoming Financially Aware Tip 1: Play Money Games

One easy way to engage children in a fun way about being financially is through money games. These ones below are useful for those based in the USA as the majority of the games are in dollars and cents. Or even if they wanted to go on holiday to the USA, it’s a good idea that they can recognize coins and notes better. Otherwise, someone might take advantage of their lack of understanding of the currency, and they could pay too much without realizing.

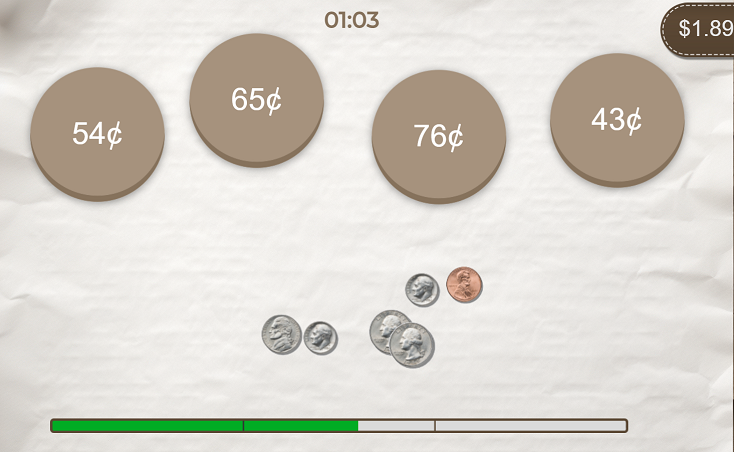

Cash Back

This is such a useful game so children can see what change they should have back from a sale. Children need that exposure to money from a young age. Either in the shops or you can start off with games like Cash Back in the comfort of your home until they have built up confidence. Especially as they can try and get quicker and quicker at working it out. The game makes it challenging as you can see if they can improve their score as the timer runs out.

Some cashiers give you so little time to do your transaction, they literally fling your shopping at you at speed. The whole process is very fast. So, they will need to be able to work it out very quickly.

It can be a bit daunting otherwise, trying to calculate it in a real life situation without experience of recognising different coins and notes firsthand with added time pressures. The people behind them in the queue are not always very patient or understanding.

Coin Saver Challenge

Children need to know they have enough money for what they want to purchase. It is embarrassing if they are shopping and have to return goods because they do not have enough money to pay for them. This game helps them quickly recognize the value of the coins they have so they know they can afford what they want to buy.

Becoming Financially Aware Tip 2: Give Them A Spending Limit

When children are confident with recognizing the notes and coins then your children are ready for the next step which is heading to the shops. Give them a set spending limit and see if they can buy what they need with it. For example, ingredients to make a meal or just the contents for their school lunchbox the following day. This will make them more aware of how to budget.

Looking at the price of items to make sure their limit will stretch far enough is a useful experience. They can see how offers and discounts play into making their shopping more affordable. Plus, they might start to see how own brands can work out cheaper too.

Becoming Financially Aware Tip 3: Start Earning Money

Children will be more financially aware if they can start to earn their own money. Some parents have a chore board with different values on it. Children then get a set amount of money for completing that particular chore. For example, put out the recycling earn for 20p or wash the dishes for 30p. Children need to know money is hard to earn and much easier to spend. So, that they value the hard work they had to do to get what they have. It will stop them being so keen to fritter it away on something frivolous.

Becoming Financially Aware Tip 4: Needs V’s Wants

As parents we are used to paying bills (needs) and not always having any money left over for what we really want or enjoy (wants). Most of us try prioritizing the items we need to stay healthy and be safe and warm. Mainly a roof over our heads, clean water to drink and healthy food to eat.

Children find this a hard lesson to learn as they do not yet have bills to pay, that’s all taken care for them by their parents. Instead, the money they earn can be used on computer games or to buy a bucket hat worth £130 – yes, I was shocked about that too!

In this case, make sure you encourage them to add money to savings. Ideally a 50/50 spilt at the very minimum so they have money behind them when they do have proper bills to pay.

An easy way though to get them used to the difference between wants and needs is to take them shopping and discuss the things you see. You can also print off activity sheets which has a list of items and children can work through deciding whether they are a want or a need. Such as needing healthy food but not junk food, needing clothes but not designer clothes.

Becoming Financially Aware Tip 5: Be A Good Role Model

Your children are watching you as they grow. Make sure you are a good role model for them so they can see the skills needed to be financially aware first hand. Show you save for what you want, not just put purchases on a credit card. Tell them how you grow your savings. Basically keep communication lines open when it comes to everything to do with money.

When you are out shopping show them how you compare the prices of products. Can you buy it cheaper elsewhere? If you can let them watch and learn from the process. It is such a valuable life lesson.

Becoming Financially Aware Tip 6: Encourage A Healthy Relationship With Money

Children should not think that the amount of money they have dictates their self-worth. It can make them spend money they don’t have, trying to keep up with other people and getting seriously in debt as a result. Such as wanting the latest car or a fancy holiday rather than being happy to make do.

They should also realize how spending can have highs and lows. When you buy something you want, it can give you a buzz. But then you feel sad because perhaps you spent money you could not afford.

Being Financially Aware Conclusion

Hopefully with these tips your children will become more financially aware quite quickly. However, don’t panic either if your children are already teens, you can quickly make up for lost ground. Start getting the message across now and undo any bad habits you have already established. They really will be grateful you took that time to get them into good money habits.